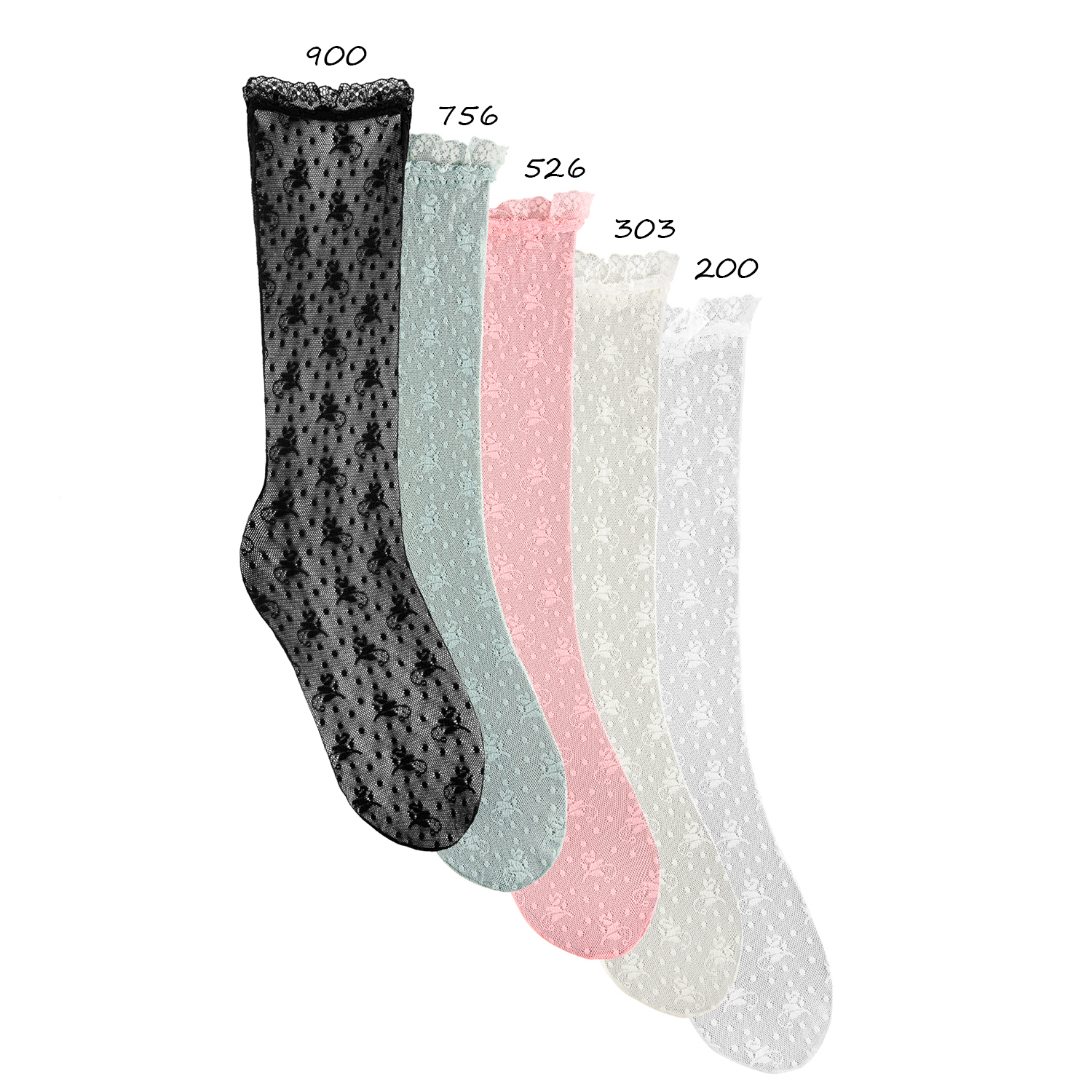

Druhy | Vzorované silonkové podkolienky Cóndor 450202756 - svetlozelená | m-shop.sk - medzisezónny výpredaj!

Druhy | Vzorované silonkové podkolienky Cóndor 450202900 - čierna | m-shop.sk - medzisezónny výpredaj!

Druhy | Hladké podkolienky so saténovou mašličkou Cóndor 248202500 - baby pink | m-shop.sk - medzisezónny výpredaj!

pančuškové silonkové nadkolienky, podkolienky, ponožky, ťapky, balerínky so zosilnenou pätou a špičkou