Amazon.com: KFD 24V AC DC Adapter Power Charger Cable for Logitech Driving Force GT Racing Wheel;Logitech G25 G27 G29 G920 G923 G940 Racing Wheel 190211-0010 190211-A030 ADP-18L R33030 APD DA-42H24 PS3 Xbox

Gran Turismo Official Steering Wheel, Logitech G25, Xbox 360 Wireless Racing Wheel, gran Turismo 5, Logitech Driving Force GT, Logitech G27, Thrustmaster, gran Turismo, racing Wheel, steering Wheel | Anyrgb

Sim Racing Gaming подставка для рулевого колеса Logitech G25 G27 PS3 PC Xbox 360 Forza 4 на PopScreen | Logitech, Steering wheel, Logitech g27

Amazon.com: NBCP Racing Wheel, Gaming Steering Wheels 1080° Driving Sim Car Simulator with Pedals Clutch Paddle Gear Shifters for Xbox One/Xbox Series X S/ PS4/ PS3/ PC/Xinput/Xbox 360/ Switch/Android : Video Games

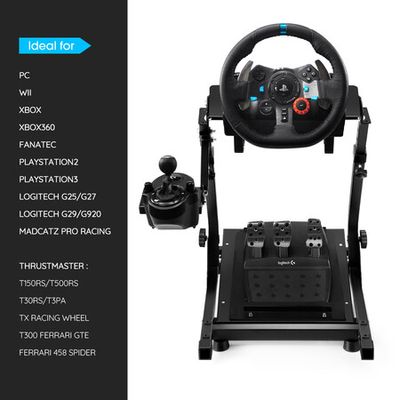

Racing Simulator Cockpit Steering Wheel Stand For Xbox Playstation Logitech G27 G29 G923 T300 Rs T500 Rs Thrustmaster - Seats, Benches & Accessoires - AliExpress

Amazon.com: DOYO Xbox 360 Game Racing Wheels,PC Steering Wheel Plug and Play Gaming Driving Volante 180° USB with Pedals Shifter Bundle for XBOX 360 / Windows PC / PS3 /Nintendo switch/Android : Video Games

Amazon.com: Replacement 24V AC DC Power Supply Cord for Logitech G25 G27 G29 G920 G923 G940, Logitech Racing Wheel APD DA-42H24 AD10110LF 190211-0010 190211-A030 PS3 Xbox 360 GT Adapter Charger Cord Cable :