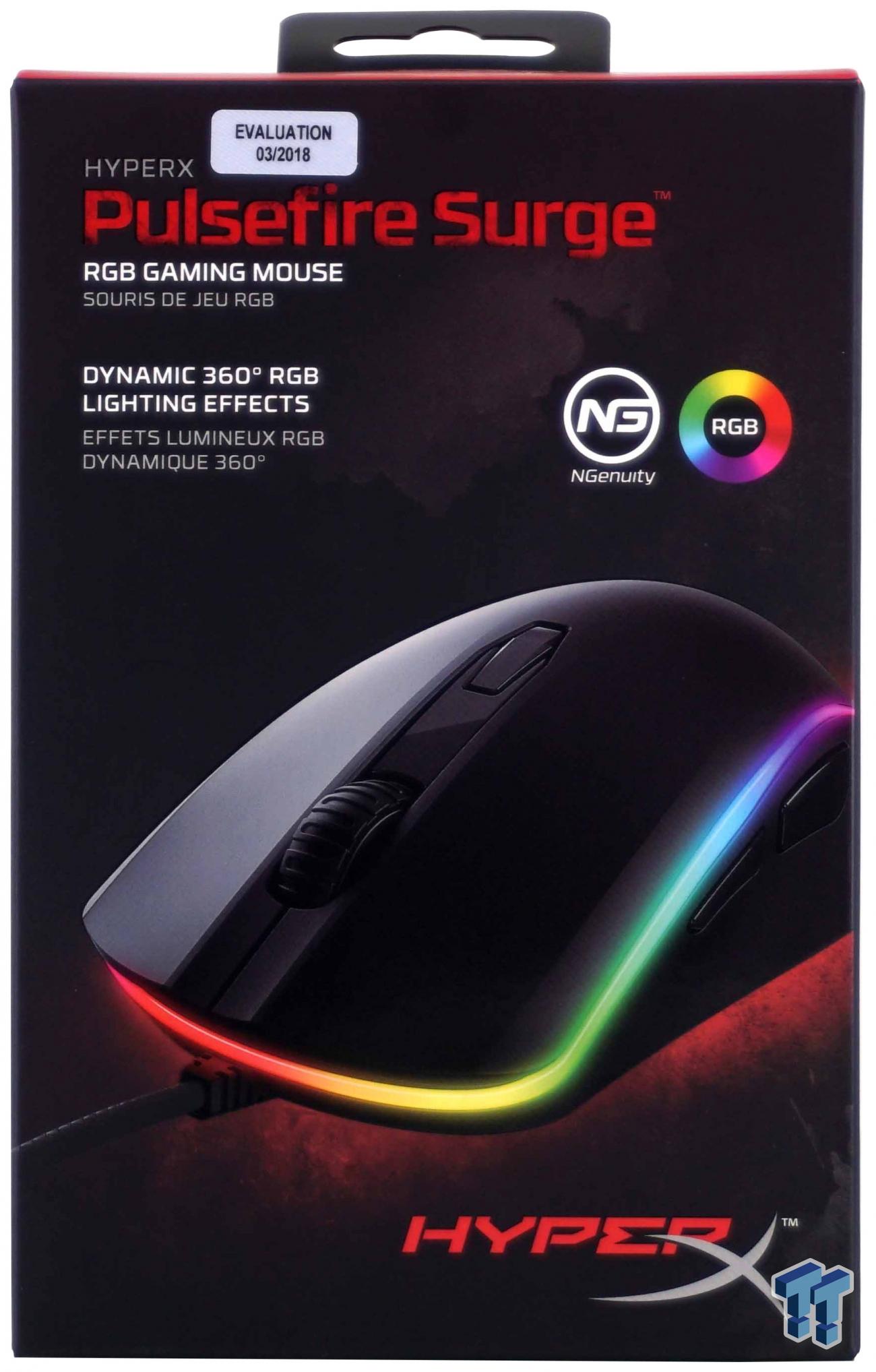

Amazon.com: HyperX Pulsefire Surge - RGB Wired Optical Gaming Mouse, Pixart 3389 Sensor up to 16000 DPI, Ergonomic, 6 Programmable Buttons, Compatible with Windows 10/8.1/8/7 - Black (Renewed) : Video Games

Kingston Hyperx Pulsefire Surge Rgb Lighting Gaming Mouse Top-tier Fps Performance Pixart 3389 Sensor With Native Up To 16000 - Mouse - AliExpress

HyperX Pulsefire Surge Wired Optical Gaming Mouse with RGB Lighting Black 4P5Q1AA/HX-MC002B - Best Buy

HyperX Pulsefire Surge – RGB Gaming Mouse Pixart 3389 Up to 16,000 DPI Easy customization with HyperX NGENUITY software| | - AliExpress